The U.S. Political Factor in Russia’s Economic Future

Economy and Sanctions Brief — February 2025

By Vladimir Milov March 03, 2025

Economy and Sanctions Brief — February 2025

By Vladimir Milov March 03, 2025

The Russian economy faces mounting challenges: high inflation, a growing budget deficit, and an economic slowdown. The Central Bank’s 21% interest rate stifles investment, while war spending drains financial reserves.

However, Trump’s administration has halted new U.S. sanctions, boosting Russia’s stock market and strengthening the ruble. If the U.S. continues easing sanctions, it could temporarily relieve pressure on Russia. Yet, the economy remains under strain, forcing Putin to resort to money printing, tax hikes, or unsustainable borrowing to fund the war.

The beginning of 2025 brought about two counter trends regarding the Russian economy. On one hand, fundamentals for the Russian economy don’t look too good:

The beginning of 2025 brought about two counter trends regarding the Russian economy. On one hand, fundamentals for the Russian economy don’t look too good:

However, on the other hand, a new lifeline for the Russian economy may be provided by an abrupt change of Russia policies by the United States under the new administration led by Donald Trump.

The Russian stock market jumped in mid‑February by about a third compared to December lows on the news about direct dialogue between Trump and Putin and expected peace talks regarding Ukraine.

The ruble exchange rate has also strengthened considerably.

While the prospects for peace talks retain a high degree of uncertainty, several other trends indicated significant improvements for Russia in the new U.S. policy:

However, on the other hand, a new lifeline for the Russian economy may be provided by an abrupt change of Russia policies by the United States under the new administration led by Donald Trump.

The Russian stock market jumped in mid‑February by about a third compared to December lows on the news about direct dialogue between Trump and Putin and expected peace talks regarding Ukraine.

The ruble exchange rate has also strengthened considerably.

While the prospects for peace talks retain a high degree of uncertainty, several other trends indicated significant improvements for Russia in the new U.S. policy:

Russian market optimism driven by new Trump policies can’t be sustainable in the long run if not followed by major easing of sanctions pressure — if the sanctions policy remains at least unchanged, the Russian economy will continue to experience increasing difficulties in accordance with the recent trend.

At the same time, however, notable sanctions relief by Trump may provide a much‑needed breathing space for the Russian government and business, delaying economic problems.

Russian market optimism driven by new Trump policies can’t be sustainable in the long run if not followed by major easing of sanctions pressure — if the sanctions policy remains at least unchanged, the Russian economy will continue to experience increasing difficulties in accordance with the recent trend.

At the same time, however, notable sanctions relief by Trump may provide a much‑needed breathing space for the Russian government and business, delaying economic problems.

The Russian annualized inflation currently stands at 10%. According to the Russian Central Bank, in January 2025, trend inflation calculated over three‑year and five‑year time intervals, accelerated, and, although seasonally adjusted monthly price growth somewhat slowed in January compared to December, “sustainable inflationary pressure remains high due to the fact that demand growth continues to outpace the capacity to increase the output of goods and services”.

As a result of that, the Central Bank decided to retain the 21% key interest rate at its Board meeting on February 14th, 2025, signaling that normalizing inflation may take longer than expected.

After that meeting, the Central Bank announced significant worsening of its inflation and interest rate forecasts:

The Russian annualized inflation currently stands at 10%. According to the Russian Central Bank, in January 2025, trend inflation calculated over three‑year and five‑year time intervals, accelerated, and, although seasonally adjusted monthly price growth somewhat slowed in January compared to December, “sustainable inflationary pressure remains high due to the fact that demand growth continues to outpace the capacity to increase the output of goods and services”.

As a result of that, the Central Bank decided to retain the 21% key interest rate at its Board meeting on February 14th, 2025, signaling that normalizing inflation may take longer than expected.

After that meeting, the Central Bank announced significant worsening of its inflation and interest rate forecasts:

Given the persistent budget deficit which seems to be out of control (see below), and output constraints caused by Western sanctions, it is unlikely that the Central Bank will be able to bring inflation under control; nearly 20 months of interest rate increase policies (since July 2023) failed to do so.

Given the persistent budget deficit which seems to be out of control (see below), and output constraints caused by Western sanctions, it is unlikely that the Central Bank will be able to bring inflation under control; nearly 20 months of interest rate increase policies (since July 2023) failed to do so.

Russia is currently ranked 12th in the world by the level of Central Bank interest rate (behind Venezuela, Turkey, Zimbabwe, Argentina, Nigeria, Egypt, Ghana, Malawi, Democratic Republic of Congo, Sierra Leone and Iran), and the stunning gap between interest rate (21%) and official inflation (10%) is a likely an indication of official inflation numbers being significantly underreported.

Russia continues to shut down alternative sources which may provide more credible inflation estimates: For instance, Russian consumer market survey service Romir has stopped publishing its monthly “Fast Moving Consumer Goods Price Index” since October 2024; the latest published figure shows that, in September 2024, inflation for basic daily consumer goods was as high as 22% year‑on-year.

It probably would have been in the range of 30–40%, or even higher by now, which is why the publication was scrapped for political reasons.

Even with this, inflation remains very high by historic standards. From November 2024 through January 2025, monthly inflation remained above 1,2% — the longest streak of such a high monthly inflation for a decade.

In the Spring of 2022, when the full‑scale invasion of Ukraine was launched, monthly inflation stood above 1,2% only for two consecutive months, March and April 2022.

Russia is currently ranked 12th in the world by the level of Central Bank interest rate (behind Venezuela, Turkey, Zimbabwe, Argentina, Nigeria, Egypt, Ghana, Malawi, Democratic Republic of Congo, Sierra Leone and Iran), and the stunning gap between interest rate (21%) and official inflation (10%) is a likely an indication of official inflation numbers being significantly underreported.

Russia continues to shut down alternative sources which may provide more credible inflation estimates: For instance, Russian consumer market survey service Romir has stopped publishing its monthly “Fast Moving Consumer Goods Price Index” since October 2024; the latest published figure shows that, in September 2024, inflation for basic daily consumer goods was as high as 22% year‑on-year.

It probably would have been in the range of 30–40%, or even higher by now, which is why the publication was scrapped for political reasons.

Even with this, inflation remains very high by historic standards. From November 2024 through January 2025, monthly inflation remained above 1,2% — the longest streak of such a high monthly inflation for a decade.

In the Spring of 2022, when the full‑scale invasion of Ukraine was launched, monthly inflation stood above 1,2% only for two consecutive months, March and April 2022.

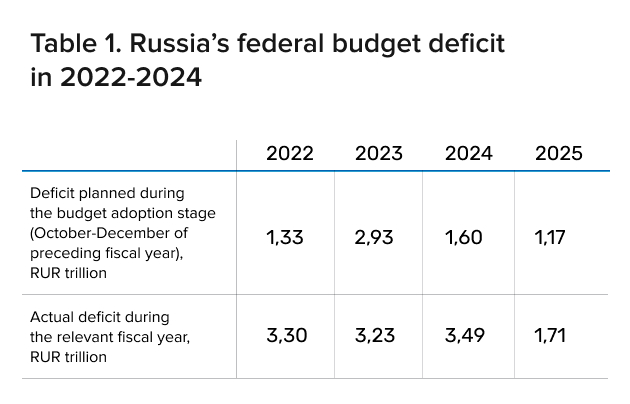

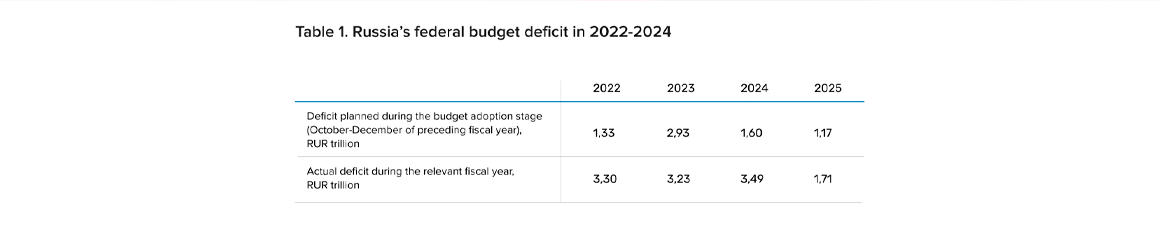

In January 2025, the Russian Ministry of Finance published data showing that Putin’s budget is heavily suffering from sanctions and record military spending. The federal budget deficit constituted a startling RUR 3,5 trillion in 2024 (USD 38 billion) .

It is remarkable that during the three years of the full‑scale invasion of Ukraine, Russia was not able to keep the budget deficit under control — initially, during the budget adoption, the deficit was planned to be relatively modest, as shown in table 1 below, but after the actual year ended, it had always turned out to be well above RUR 3 trillion.

During 2024 alone, the budget deficit was reconsidered four times, ending up being 2,2 times higher than initially planned at the end of 2023.

This means that Russia can’t effectively control its wartime spending, which results in higher deficits on the background of revenues suppressed by Western sanctions.

The cumulative three‑year federal budget deficit of 2022–2024 totaled at over RUR 10 trillion, or around USD 125 billion.

In January 2025, the Russian federal budget deficit exploded further, reaching RUR 1,7 billion — nearly 1,5 times higher than the whole deficit planned for 12 months of 2025.

Although this figure mostly reflects January advance payments to the military complex, and will be somewhat reduced during later months, it also shows that it will be tremendously difficult for Russia to keep the 2025 deficit within the planned limits.

In January 2025, the Russian Ministry of Finance published data showing that Putin’s budget is heavily suffering from sanctions and record military spending. The federal budget deficit constituted a startling RUR 3,5 trillion in 2024 (USD 38 billion) .

It is remarkable that during the three years of the full‑scale invasion of Ukraine, Russia was not able to keep the budget deficit under control — initially, during the budget adoption, the deficit was planned to be relatively modest, as shown in table 1 below, but after the actual year ended, it had always turned out to be well above RUR 3 trillion.

During 2024 alone, the budget deficit was reconsidered four times, ending up being 2,2 times higher than initially planned at the end of 2023.

This means that Russia can’t effectively control its wartime spending, which results in higher deficits on the background of revenues suppressed by Western sanctions.

The cumulative three‑year federal budget deficit of 2022–2024 totaled at over RUR 10 trillion, or around USD 125 billion.

In January 2025, the Russian federal budget deficit exploded further, reaching RUR 1,7 billion — nearly 1,5 times higher than the whole deficit planned for 12 months of 2025.

Although this figure mostly reflects January advance payments to the military complex, and will be somewhat reduced during later months, it also shows that it will be tremendously difficult for Russia to keep the 2025 deficit within the planned limits.

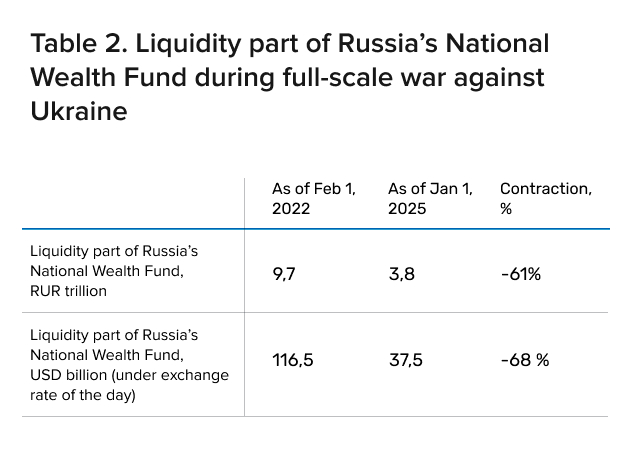

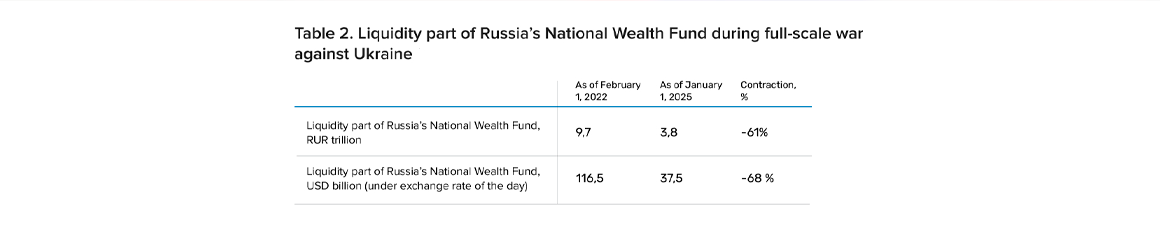

As a result of a heavy drawdown of cash from the National Wealth Fund (NWF), the Russian government’s rainy day fund, to finance the budget deficit, the liquidity portion of the NWF has shrunk by January 1, 2025, to an all‑time low of just RUR 3,8 trillion (USD 37,5 billion).

The NWF lost about two thirds of its value during the three years of the full‑scale war against Ukraine in 2022–2024. By February 1, 2025, the liquidity portion of the NWF has shrunk further to RUR 3,75 trillion.

It may well be said that the liquidity portion of the NWF is already effectively spent, because, as can be seen, the remaining cash is roughly equal to the actual budget deficit of one year (as actually recorded in 2022–2024).

However, it is quite possible that Putin will choose to stop spending the remaining liquidity part of the NWF to continue financing budget deficits as before, because he needs the NWF cash for shocks and all sorts of potential “black swans” — starting from the possible fall of oil prices.

So, either the remaining cash in the NWF will be spent in 2025 to finance the budget deficit (which will again be presumably much higher than the currently planned modest RUR 1,2 trillion), or it will be kept as an irreducible reserve for shocks, which means that Putin has to find other ways to finance the budget deficit for 2025.

Most likely, this will be monetary emission, as discussed later in Annex 1 of this report. Annex 1 examines whether there are still options left for the Government to finance the budget deficit apart from the drawdown of funds from the NWF.

As a result of a heavy drawdown of cash from the National Wealth Fund (NWF), the Russian government’s rainy day fund, to finance the budget deficit, the liquidity portion of the NWF has shrunk by January 1, 2025, to an all‑time low of just RUR 3,8 trillion (USD 37,5 billion).

The NWF lost about two thirds of its value during the three years of the full‑scale war against Ukraine in 2022–2024. By February 1, 2025, the liquidity portion of the NWF has shrunk further to RUR 3,75 trillion.

It may well be said that the liquidity portion of the NWF is already effectively spent, because, as can be seen, the remaining cash is roughly equal to the actual budget deficit of one year (as actually recorded in 2022–2024).

However, it is quite possible that Putin will choose to stop spending the remaining liquidity part of the NWF to continue financing budget deficits as before, because he needs the NWF cash for shocks and all sorts of potential “black swans” — starting from the possible fall of oil prices.

So, either the remaining cash in the NWF will be spent in 2025 to finance the budget deficit (which will again be presumably much higher than the currently planned modest RUR 1,2 trillion), or it will be kept as an irreducible reserve for shocks, which means that Putin has to find other ways to finance the budget deficit for 2025.

Most likely, this will be monetary emission, as discussed later in Annex 1 of this report. Annex 1 examines whether there are still options left for the Government to finance the budget deficit apart from the drawdown of funds from the NWF.

The massive fiscal deficit of 2022–2024 and the corresponding drying out of Russia’s financial reserves is the direct product of Western sanctions introduced against Russia since 2022.

The massive fiscal deficit of 2022–2024 and the corresponding drying out of Russia’s financial reserves is the direct product of Western sanctions introduced against Russia since 2022.

Russian authorities continue to acknowledge a notable slowdown of the economy. On February 17th, Minister of Economic Development Maxim Reshetnikov, speaking at an annual board meeting of the Ministry, admitted:

Russian authorities continue to acknowledge a notable slowdown of the economy. On February 17th, Minister of Economic Development Maxim Reshetnikov, speaking at an annual board meeting of the Ministry, admitted:

“The first signs of cooling in the economy are now appearing. Already based on the results of November and December, we see that growth has ceased to be frontal. The pace has slowed in a number of industries: food, chemicals, in the food industry, the chemical industry, woodworking, and certain branches of machinebuilding. Volume of orders declined in the automobile market, due to high interest rates on loans, sales of cars, agricultural and special equipment are falling,” Reshetnikov said.

“The first signs of cooling in the economy are now appearing. Already based on the results of November and December, we see that growth has ceased to be frontal. The pace has slowed in a number of industries: food, chemicals, in the food industry, the chemical industry, woodworking, and certain branches of machinebuilding. Volume of orders declined in the automobile market, due to high interest rates on loans, sales of cars, agricultural and special equipment are falling,” Reshetnikov said.

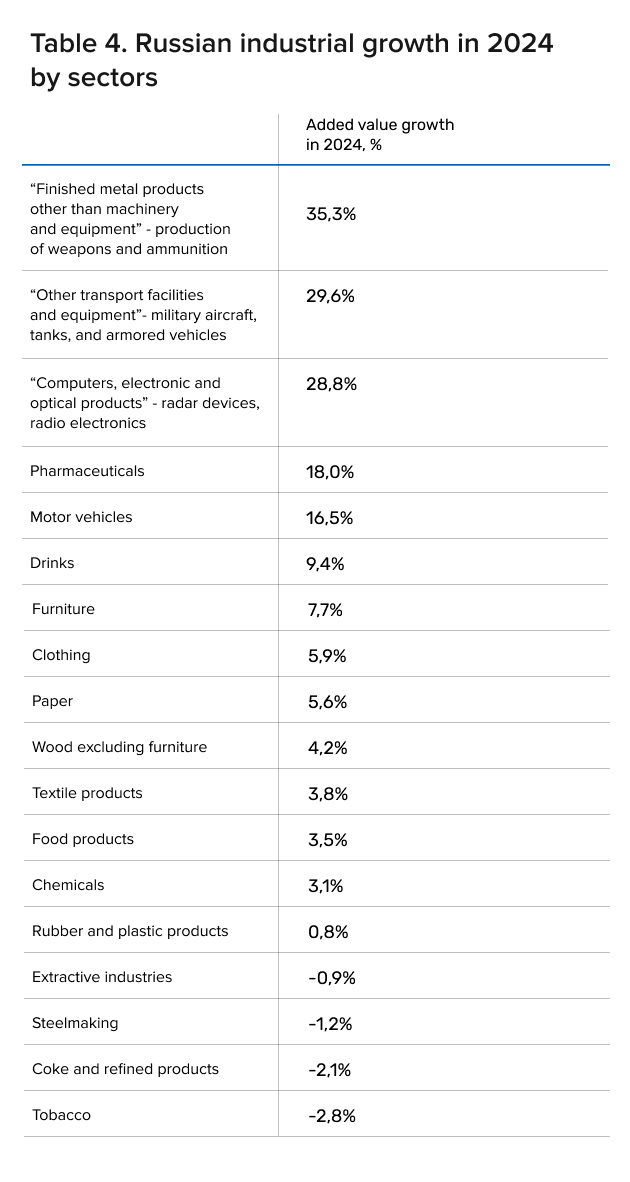

In January 2025, according to Russian statistics agency Rosstat, industrial growth plunged to two‑year low of just 2,2% year‑on-year, against 4,5–4,6% growth recorded in 2023 and 2024, and against an economists' consensus forecasts, which projected January industrial growth above 5%.

In most non‑military industries, growth was even lower or negative, because the 2,2% figure is largely driven by 20–30% growth in military‑related industries.

As a matter of fact, January figures show that Russia has already entered the 'stagflation' scenario discussed earlier: very low growth combined with persistent high inflation.

In January 2025, according to Russian statistics agency Rosstat, industrial growth plunged to two‑year low of just 2,2% year‑on-year, against 4,5–4,6% growth recorded in 2023 and 2024, and against an economists' consensus forecasts, which projected January industrial growth above 5%.

In most non‑military industries, growth was even lower or negative, because the 2,2% figure is largely driven by 20–30% growth in military‑related industries.

As a matter of fact, January figures show that Russia has already entered the 'stagflation' scenario discussed earlier: very low growth combined with persistent high inflation.

What about the impressive 4,1% GDP growth figure reported by the Russian Government, then?

First, GDP growth is slowing down rapidly: while it was as high as 5,4% in Q1 2024 and 4,1% in Q2 2024, in Q3 and Q4 2024, it has slowed down to 3,1%.

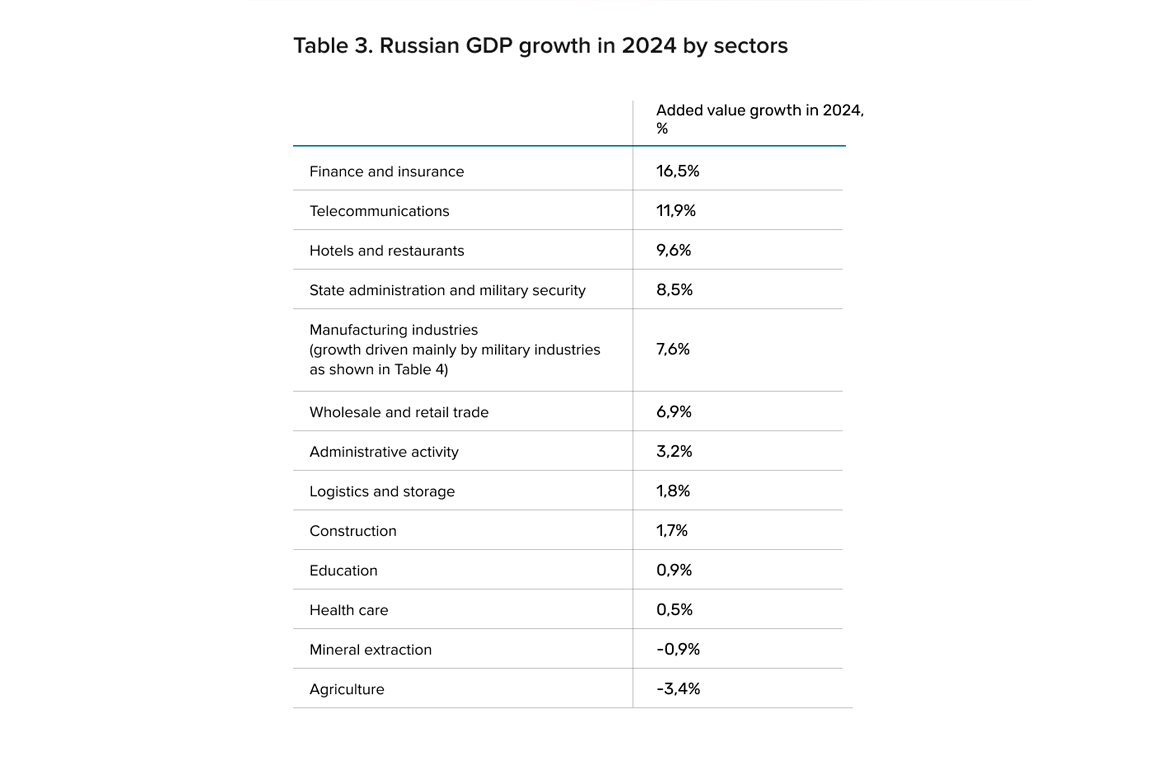

Second, GDP growth of over 4% is a result of an imbalance between state‑financed military industries boom and bank’s superprofits (which is a temporary factor), and an unimpressive performance of most civilian industries, as shown in tables 3–4 below.

What about the impressive 4,1% GDP growth figure reported by the Russian Government, then?

First, GDP growth is slowing down rapidly: while it was as high as 5,4% in Q1 2024 and 4,1% in Q2 2024, in Q3 and Q4 2024, it has slowed down to 3,1%.

Second, GDP growth of over 4% is a result of an imbalance between state‑financed military industries boom and bank’s superprofits (which is a temporary factor), and an unimpressive performance of most civilian industries, as shown in tables 3–4 below.

As the government‑linked Center for Macroeconomic Analysis and Short‑Term Forecasting (known under Russian abbreviation CMAKP) admits, the current Russian output dynamics is heavily driven by military production, while output in most civilian industries is depressed: since mid‑2023, industrial production excluding military‑related industries has increased at the end of 2024 only by around 1%.

As the government‑linked Center for Macroeconomic Analysis and Short‑Term Forecasting (known under Russian abbreviation CMAKP) admits, the current Russian output dynamics is heavily driven by military production, while output in most civilian industries is depressed: since mid‑2023, industrial production excluding military‑related industries has increased at the end of 2024 only by around 1%.

As was noted above in Economic Minister Reshetnikov’c comments, one of the leaders of civilian industrial growth, motor vehicles production, is already notably slowing down.

Military production growth isn’t sustainable at all, given multiple constraints: draining budget funds, labor shortages, capacity expansion constrained by sanctions, and lack of access to necessary equipment and technology.

As was noted above in Economic Minister Reshetnikov’c comments, one of the leaders of civilian industrial growth, motor vehicles production, is already notably slowing down.

Military production growth isn’t sustainable at all, given multiple constraints: draining budget funds, labor shortages, capacity expansion constrained by sanctions, and lack of access to necessary equipment and technology.

The next Central Bank’s Board meeting on key interest rate is scheduled for March 21st, and the Bank finds itself in a difficult position: unless inflation miraculously cools down, it will have to at least maintain high interest rates, if not to increase them.

At a press conference following the February 14th meeting, Central Bank Chairman Elvira Nabiullina admitted that the Bank hasn’t considered lowering interest rates in the current situation: the choice was only between keeping them at the current levels or raising them further.

But even the current interest rates are already notably cooling the economy, as noted above.

The next Central Bank’s Board meeting on key interest rate is scheduled for March 21st, and the Bank finds itself in a difficult position: unless inflation miraculously cools down, it will have to at least maintain high interest rates, if not to increase them.

At a press conference following the February 14th meeting, Central Bank Chairman Elvira Nabiullina admitted that the Bank hasn’t considered lowering interest rates in the current situation: the choice was only between keeping them at the current levels or raising them further.

But even the current interest rates are already notably cooling the economy, as noted above.

Hopes to bring down inflation appear illusory, particularly on the background following the rapidly accelerated federal budget spending in December‑January: in December, the federal Government spent over RUR 7 trillion, and in January 2025 — RUR 4,4 trillion, or 2–3 times higher than the normal monthly level for two consecutive months.

Enormous budget expansion of the recent months is a factor that, as the Central Bank admits, negatively offsets the disinflationary effects of some credit cooling caused by high interest rates.

Hopes to bring down inflation appear illusory, particularly on the background following the rapidly accelerated federal budget spending in December‑January: in December, the federal Government spent over RUR 7 trillion, and in January 2025 — RUR 4,4 trillion, or 2–3 times higher than the normal monthly level for two consecutive months.

Enormous budget expansion of the recent months is a factor that, as the Central Bank admits, negatively offsets the disinflationary effects of some credit cooling caused by high interest rates.

So far, several trends can be observed in connection with Donald Trump’s policies vis‑a-vis Russia.

So far, several trends can be observed in connection with Donald Trump’s policies vis‑a-vis Russia.

All these policy trends are exclusively beneficial for Moscow, which has already resulted in an unprecedented Russian stock market rally and strengthening of the ruble.

Whether this “soft start” of Trump’s presidency will further benefit Russia and support the improvement of Russia’s economic fundamentals remains to be seen; the formal or de‑facto dismantling of the U.S. sanctions regime against Russia will only have partial positive impact for Russia once the sanctions imposed by the EU, UK and other Western democracies remain in place.

However, Trump’s de‑facto easing of the sanctions regime against Russia risks providing Putin with a much‑needed partial relief from sanctions pressure at a crucial time when Russia’s own resources to continue the war are running scarce.

All these policy trends are exclusively beneficial for Moscow, which has already resulted in an unprecedented Russian stock market rally and strengthening of the ruble.

Whether this “soft start” of Trump’s presidency will further benefit Russia and support the improvement of Russia’s economic fundamentals remains to be seen; the formal or de‑facto dismantling of the U.S. sanctions regime against Russia will only have partial positive impact for Russia once the sanctions imposed by the EU, UK and other Western democracies remain in place.

However, Trump’s de‑facto easing of the sanctions regime against Russia risks providing Putin with a much‑needed partial relief from sanctions pressure at a crucial time when Russia’s own resources to continue the war are running scarce.

In the beginning of 2025, Putin has reached a crucial breaking point regarding his economic abilities to continue to wage war against Ukraine:

In the beginning of 2025, Putin has reached a crucial breaking point regarding his economic abilities to continue to wage war against Ukraine:

All these developments are a clear product of Western sanctions imposed from 2022–2024.

However, partial relief from the sanctions regime provided to Russia by the Trump administration risks improving the situation for Putin considerably.

All these developments are a clear product of Western sanctions imposed from 2022–2024.

However, partial relief from the sanctions regime provided to Russia by the Trump administration risks improving the situation for Putin considerably.

These forthcoming events of data will shed more light on the dynamics of the Russian economy in 2025:

These forthcoming events of data will shed more light on the dynamics of the Russian economy in 2025:

This annex examines in more detail whether Putin has other options to fill the budget deficit gap after the liquidity portion of the National Wealth Fund (NWF) expires.

This annex examines in more detail whether Putin has other options to fill the budget deficit gap after the liquidity portion of the National Wealth Fund (NWF) expires.

Why is it important to mostly focus on the liquidity portion of the NWF, and to disregard the other, non‑liquidity part (another RUR 8 trillion, or USD 79 billion)?

The latter largely exists on paper only, being invested in assets which either can’t be sold for political reasons, or can’t generate sufficient cash for a swift payback to the NWF.

For instance, about half of NWF’s non‑liquidity assets — nearly RUR 4 trillion out of total 8 trillion — are kept in shares of Sberbank (control equity stake of 50%+1 share) and Russian Railways.

The Russian government just won’t realistically privatize these shares, considering maintaining control in Sberbank and 100% ownership of Russian Railways as strategic.

Why is it important to mostly focus on the liquidity portion of the NWF, and to disregard the other, non‑liquidity part (another RUR 8 trillion, or USD 79 billion)?

The latter largely exists on paper only, being invested in assets which either can’t be sold for political reasons, or can’t generate sufficient cash for a swift payback to the NWF.

For instance, about half of NWF’s non‑liquidity assets — nearly RUR 4 trillion out of total 8 trillion — are kept in shares of Sberbank (control equity stake of 50%+1 share) and Russian Railways.

The Russian government just won’t realistically privatize these shares, considering maintaining control in Sberbank and 100% ownership of Russian Railways as strategic.

Another 11% of the NWF’s non‑liquidity assets is invested in shares of other state‑linked companies and banks — theoretically, these can be privatized, but Putin and the top management of state companies in question have been resisting this for decades to avoid outside influence on management of these companies.

It’s more realistic to expect that the Government will switch to missionary financing of the budget deficit, rather than let go of strategic ownership of key economic assets owned by Putin’s cronies.

Another quarter of NWF’s non‑liquidity assets (around RUR 2 trillion) are investments in bonds of various state‑linked companies, most of which do not generate any significant returns.

Two thirds of these funds are invested in the transportation sector companies (road construction monopoly Rosavtodor, airline insurers and leasers, State Transport Leasing Company), which are barely profitable and can’t ensure fast recovery of invested NWF funds.

Another 11% of the NWF’s non‑liquidity assets is invested in shares of other state‑linked companies and banks — theoretically, these can be privatized, but Putin and the top management of state companies in question have been resisting this for decades to avoid outside influence on management of these companies.

It’s more realistic to expect that the Government will switch to missionary financing of the budget deficit, rather than let go of strategic ownership of key economic assets owned by Putin’s cronies.

Another quarter of NWF’s non‑liquidity assets (around RUR 2 trillion) are investments in bonds of various state‑linked companies, most of which do not generate any significant returns.

Two thirds of these funds are invested in the transportation sector companies (road construction monopoly Rosavtodor, airline insurers and leasers, State Transport Leasing Company), which are barely profitable and can’t ensure fast recovery of invested NWF funds.

Another 20% of bonds held by NWF are those of Rostec, Russia’s main weapons producer, which, as admitted by its own CEO Sergey Chemezov, hardly makes any profits.

RUR 60 billion of NWF funds are even invested in bonds issued by VK, Russia’s video hosting developed as an alternative to Youtube, which wasn’t able to turn profitable after decades of operation.

Around 1 trillion of NWF funds are kept at deposits at state banks like VEB and Gazprombank (mostly VEB), which are an essential part of these banks' capital.

Withdrawal of these funds will strip VEB out of most of its capital and expose it to bankruptcy. As a cherry on top, NWF also lists among its assets $3 billion (4% of NWF’s non‑liquidity assets) invested in Ukrainian government bonds under President Yanukovich to support him during the months of Euromaidan protests in late 2013, which are not recoverable.

In 2023, the U. K. Supreme Court decided that the case regarding Ukraine’s $3 billion Eurobond debt to Russia should be sent to trial until which Ukraine will be exempted from making the debt payments.

Another 20% of bonds held by NWF are those of Rostec, Russia’s main weapons producer, which, as admitted by its own CEO Sergey Chemezov, hardly makes any profits.

RUR 60 billion of NWF funds are even invested in bonds issued by VK, Russia’s video hosting developed as an alternative to Youtube, which wasn’t able to turn profitable after decades of operation.

Around 1 trillion of NWF funds are kept at deposits at state banks like VEB and Gazprombank (mostly VEB), which are an essential part of these banks' capital.

Withdrawal of these funds will strip VEB out of most of its capital and expose it to bankruptcy. As a cherry on top, NWF also lists among its assets $3 billion (4% of NWF’s non‑liquidity assets) invested in Ukrainian government bonds under President Yanukovich to support him during the months of Euromaidan protests in late 2013, which are not recoverable.

In 2023, the U. K. Supreme Court decided that the case regarding Ukraine’s $3 billion Eurobond debt to Russia should be sent to trial until which Ukraine will be exempted from making the debt payments.

So, in essence, the non‑liquidity assets of the NWF are smoke and mirrors — these funds can’t be recovered easily, if at all, in the observable future, and, therefore, can’t serve as a readily available tool for financing the war for Putin.

Notably, the share of non‑liquidity assets within the NWF has jumped from 35% on February 1st, 2022, before the full‑scale invasion of Ukraine began, to 68% now — apart from spending the NWF money to finance the budget deficit, the Russian government also heavily invested it into state‑linked projects which barely generate any profits.

So, in essence, the non‑liquidity assets of the NWF are smoke and mirrors — these funds can’t be recovered easily, if at all, in the observable future, and, therefore, can’t serve as a readily available tool for financing the war for Putin.

Notably, the share of non‑liquidity assets within the NWF has jumped from 35% on February 1st, 2022, before the full‑scale invasion of Ukraine began, to 68% now — apart from spending the NWF money to finance the budget deficit, the Russian government also heavily invested it into state‑linked projects which barely generate any profits.

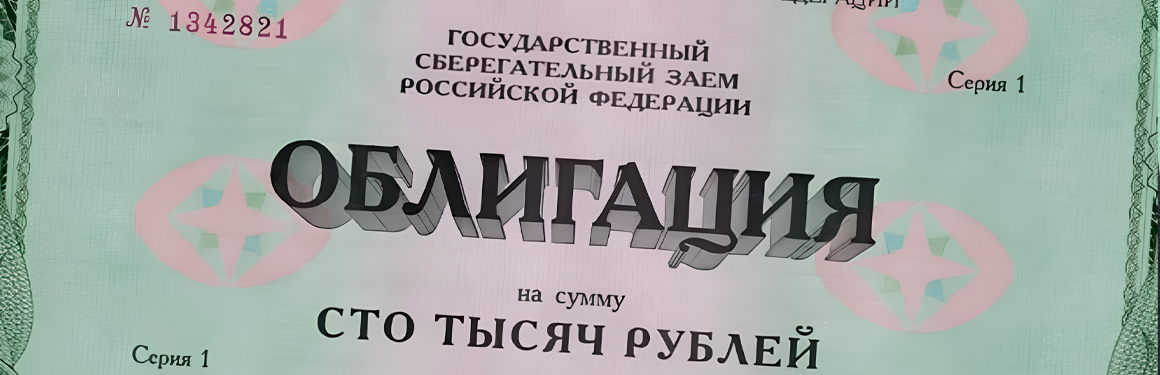

On the background of heavy fiscal losses and depletion of the NWF, Putin must find new ways of financing the budget deficit. One major hope for the Russian government was borrowing: while Russia is cut off from the international financial markets, it was relying on domestic borrowing through the Ministry of Finance’s state bonds (OFZ).

On the background of heavy fiscal losses and depletion of the NWF, Putin must find new ways of financing the budget deficit. One major hope for the Russian government was borrowing: while Russia is cut off from the international financial markets, it was relying on domestic borrowing through the Ministry of Finance’s state bonds (OFZ).

However, with high interest rates, the interest expenses for the federal budget turned out to be so high that the positive fiscal effect from borrowing was near zero: in 2024, Russia spent nearly a similar amount on debt service costs (RUR 2,2 trillion) as net debt raised (RUR 2,5 trillion).

High debt servicing costs was a major factor adding to the ballooning budget deficit of 2024. In the environment of high interest rates, borrowing is not an option to solve the budget deficit problem.

However, with high interest rates, the interest expenses for the federal budget turned out to be so high that the positive fiscal effect from borrowing was near zero: in 2024, Russia spent nearly a similar amount on debt service costs (RUR 2,2 trillion) as net debt raised (RUR 2,5 trillion).

High debt servicing costs was a major factor adding to the ballooning budget deficit of 2024. In the environment of high interest rates, borrowing is not an option to solve the budget deficit problem.

This is an option that Putin has already resorted to in the past three years. Since January 1, 2025, another major tax increase package worth around RUR 3 trillion entered into force, with two thirds of the planned extra revenue expected to be collected from an increase of corporate profit tax rate from 20% to 25%.

This tax increase is already incorporated in the budget figures provided above, and hasn’t helped to escape the enormous budget deficits described earlier in this report.

This is an option that Putin has already resorted to in the past three years. Since January 1, 2025, another major tax increase package worth around RUR 3 trillion entered into force, with two thirds of the planned extra revenue expected to be collected from an increase of corporate profit tax rate from 20% to 25%.

This tax increase is already incorporated in the budget figures provided above, and hasn’t helped to escape the enormous budget deficits described earlier in this report.

Further tax hikes will continue to hurt investment and economic recovery; the Russian government has already admitted contraction of investment programs by businesses as a combined result of high interest rates and tax hikes, as well as shrinking of the tax revenue base and contraction of corporate profit tax collection in 2024 as a result of the government’s policies.

Tax hikes, in this regard, are a possibility, but a costly option for Putin: they would hurt investment, growth, and undermine the tax revenue base for the coming years.

Further tax hikes will continue to hurt investment and economic recovery; the Russian government has already admitted contraction of investment programs by businesses as a combined result of high interest rates and tax hikes, as well as shrinking of the tax revenue base and contraction of corporate profit tax collection in 2024 as a result of the government’s policies.

Tax hikes, in this regard, are a possibility, but a costly option for Putin: they would hurt investment, growth, and undermine the tax revenue base for the coming years.

The other option that Russia has resorted to in end‑2024 was de‑facto monetary emission scheme through the Central Bank’s monthly repo auctions which were once again made available for the Russian banks.

The Central Bank has previously halted monthly repo auctions since the end of 2023, but restarted them in November 2024 — banks have raised nearly the same amount than they later spent on buying Minfin’s OFZ bonds in December (RUR 2 trillion). With this scheme, Minfin was able to fulfill its borrowing plan for 2024 (however, as shown above, to little positive fiscal effect).

The other option that Russia has resorted to in end‑2024 was de‑facto monetary emission scheme through the Central Bank’s monthly repo auctions which were once again made available for the Russian banks.

The Central Bank has previously halted monthly repo auctions since the end of 2023, but restarted them in November 2024 — banks have raised nearly the same amount than they later spent on buying Minfin’s OFZ bonds in December (RUR 2 trillion). With this scheme, Minfin was able to fulfill its borrowing plan for 2024 (however, as shown above, to little positive fiscal effect).

This scheme looks really no different than the direct credit from the Central Bank to the government, or simply a classical monetary emission.

However, the Central Bank promises that monthly repo auctions will be “strictly temporary and non‑inflationary,” and that the banks will simply repay the repo loans in due time.

However, as of February 2025, the Central Bank has not kept its promise to halt monthly repo auctions, and keeps rolling the banks' debt over. If this scheme will be extended in time, it will be no different from direct lending to the government by the Central Bank.

In the absence of other ways to fill the budget spending gap, it is likely that Russia will more and more resort to monetary emission as a major tool of managing the budget deficit.

Naturally, this will have further negative effect on inflation.

This scheme looks really no different than the direct credit from the Central Bank to the government, or simply a classical monetary emission.

However, the Central Bank promises that monthly repo auctions will be “strictly temporary and non‑inflationary,” and that the banks will simply repay the repo loans in due time.

However, as of February 2025, the Central Bank has not kept its promise to halt monthly repo auctions, and keeps rolling the banks' debt over. If this scheme will be extended in time, it will be no different from direct lending to the government by the Central Bank.

In the absence of other ways to fill the budget spending gap, it is likely that Russia will more and more resort to monetary emission as a major tool of managing the budget deficit.

Naturally, this will have further negative effect on inflation.

Moreover, importantly, the Western sanctions have restrained all other reasonable ways to finance heavy wartime spending for Russia, so that Russia has no other option but to resort to pro‑inflationary, emissive measures like raising government debt through hidden Central Bank loans.

This will not only increase inflationary pressure and complicate Russia’s economic recovery, but also cap the potential further increase of budget military spending.

This effect is already visible with the federal budget adopted for 2025, where the growth in military spending is envisaged only by 26% as compared to 2024 (in 2024 relative to 2023, growth in military spending was nearly 70% — Russia could have afforded much higher growth of military expenses when larger financial reserves were still available).

Moreover, importantly, the Western sanctions have restrained all other reasonable ways to finance heavy wartime spending for Russia, so that Russia has no other option but to resort to pro‑inflationary, emissive measures like raising government debt through hidden Central Bank loans.

This will not only increase inflationary pressure and complicate Russia’s economic recovery, but also cap the potential further increase of budget military spending.

This effect is already visible with the federal budget adopted for 2025, where the growth in military spending is envisaged only by 26% as compared to 2024 (in 2024 relative to 2023, growth in military spending was nearly 70% — Russia could have afforded much higher growth of military expenses when larger financial reserves were still available).

More Uncertainty Follows as the Central Bank Yields to Pressure

By Vladimir Milov

January 13, 2025

Report

Report Between inflation and stagflation, lobbyists versus bankers, and the need for sanctions control

By Vladimir Milov

November 20, 2024

Report

Report Inflation, budget and labor shortages, and a cooling of relations with China

By Vladimir Milov

October 15, 2024

More Uncertainty Follows as the Central Bank Yields to Pressure

By Vladimir Milov

January 13, 2025

Report

Report Between inflation and stagflation, lobbyists versus bankers, and the need for sanctions control

By Vladimir Milov

November 20, 2024

Report

Report Inflation, budget and labor shortages, and a cooling of relations with China

By Vladimir Milov

October 15, 2024