The Russian Economy and Sanctions Brief — January 2025

More Uncertainty Follows as the Central Bank Yields to Pressure

By Vladimir Milov January 13, 2025

More Uncertainty Follows as the Central Bank Yields to Pressure

By Vladimir Milov January 13, 2025

In January 2025, the Russian economy faces mounting challenges. The Central Bank unexpectedly kept the key interest rate at 21%, despite accelerating inflation. Weekly inflation rates reached 0.5%, while monthly inflation hit a 22‑year record.

Meanwhile, the economic downturn continues, increasing pressure on the federal budget and forcing the government to spend the National Wealth Fund reserves. Cooperation with China has failed to deliver the anticipated results, and Donald Trump’s election may further complicate Russia’s economic situation in 2025.

On December 20, the Russian Central Bank surprised most analysts and went back on its word by refusing to raise the key interest rate, keeping it at 21%. Against this background:

On December 20, the Russian Central Bank surprised most analysts and went back on its word by refusing to raise the key interest rate, keeping it at 21%. Against this background:

On December 20, 2024, the Russian Central Bank took a surprising pause in raising the key interest rate, defying expectations and breaking its own promises to continue raising rates if inflation didn’t calm down, which hadn’t happened. While most analysts expected a rate hike from 21% to 23%, some thought that the interest rate would be raised to as high as 25%.

These expectations were fueled by dismal inflation data: in November‑December 2024, weekly inflation exceeded 0,3%, which is equivalent to over 1,4% per month (about 20% per year). Earlier in December, weekly inflation was reaching as much as 0,5%. Monthly inflation in November‑December (1,43% in November, 1,3% after 23 days of December; more recent data will not be available until January 15, 2025) was the highest in 22 years (since 2002). The Central Bank estimates that inflation will reach 9,6–9,8% after 12 months of 2024.

Keeping the key interest rate unchanged in these circumstances contradicts the Central Bank’s pledge made in November after the previous interest rate meeting on October 25. Back then, the Central Bank unequivocally stated that «keeping the key rate unchanged at the next meeting [in December] would only be possible in case of a considerable deceleration of underlying inflation». That wasn’t the case; moreover, inflation accelerated since then.

On December 20, 2024, the Russian Central Bank took a surprising pause in raising the key interest rate, defying expectations and breaking its own promises to continue raising rates if inflation didn’t calm down, which hadn’t happened. While most analysts expected a rate hike from 21% to 23%, some thought that the interest rate would be raised to as high as 25%.

These expectations were fueled by dismal inflation data: in November‑December 2024, weekly inflation exceeded 0,3%, which is equivalent to over 1,4% per month (about 20% per year). Earlier in December, weekly inflation was reaching as much as 0,5%. Monthly inflation in November‑December (1,43% in November, 1,3% after 23 days of December; more recent data will not be available until January 15, 2025) was the highest in 22 years (since 2002). The Central Bank estimates that inflation will reach 9,6–9,8% after 12 months of 2024.

Keeping the key interest rate unchanged in these circumstances contradicts the Central Bank’s pledge made in November after the previous interest rate meeting on October 25. Back then, the Central Bank unequivocally stated that «keeping the key rate unchanged at the next meeting [in December] would only be possible in case of a considerable deceleration of underlying inflation». That wasn’t the case; moreover, inflation accelerated since then.

Why did the Central Bank change its policies so drastically, refusing to further raise the interest rate against the background of inflation accelerating, not moderating?

One obvious answer is yielding to political and lobbyist pressure, as discussed in our latest November brief on the Russian economy and sanctions. A day before the Central Bank’s Board meeting, on December 19, Vladimir Putin explicitly stated during his annual press conference that the Central Bank had «shortcomings» in its inflation policies, and that it should have been using tools that were «not related to raising the key rate».

Why did the Central Bank change its policies so drastically, refusing to further raise the interest rate against the background of inflation accelerating, not moderating?

One obvious answer is yielding to political and lobbyist pressure, as discussed in our latest November brief on the Russian economy and sanctions. A day before the Central Bank’s Board meeting, on December 19, Vladimir Putin explicitly stated during his annual press conference that the Central Bank had «shortcomings» in its inflation policies, and that it should have been using tools that were «not related to raising the key rate».

Speaking live on RBC Investments, Sberbank’s chief analyst Natalia Zagvozdina noted that, according to Sberbank’s study which used a large language model (LLM), the Russian Central Bank drastically changed its rhetoric on December 20. Previously, it was mostly concerned with inflation; at the December press conference, however, the word «inflation» was used half as much as usual, the least on record.

Unexpectedly, the Central Bank shifted from emphasizing inflation to stressing «cooling of corporate lending», which, as was explained, paved way for inflation abatement in the future. At the same time, public data suggested that corporate credit was, in fact, accelerating, from 2,0% compared to the previous month in September to 2,3% in October. Speaking to the State Duma on November 19, 2024, Russian Central Bank Governor Elvira Nabiullina stated that the Central Bank didn’t «see any cooling of corporate lending».

Speaking live on RBC Investments, Sberbank’s chief analyst Natalia Zagvozdina noted that, according to Sberbank’s study which used a large language model (LLM), the Russian Central Bank drastically changed its rhetoric on December 20. Previously, it was mostly concerned with inflation; at the December press conference, however, the word «inflation» was used half as much as usual, the least on record.

Unexpectedly, the Central Bank shifted from emphasizing inflation to stressing «cooling of corporate lending», which, as was explained, paved way for inflation abatement in the future. At the same time, public data suggested that corporate credit was, in fact, accelerating, from 2,0% compared to the previous month in September to 2,3% in October. Speaking to the State Duma on November 19, 2024, Russian Central Bank Governor Elvira Nabiullina stated that the Central Bank didn’t «see any cooling of corporate lending».

It was only after December 20 that the Central Bank released new data that did show some cooling of corporate crediting in November; still, it doesn’t appear to make the hypothesis of «significant cooling» of corporate lending any more convincing. In November, corporate credit was still up by 0,8% month‑over-month; this included growth in lending in rubles (the most impactful regarding inflation) by 1,5% and a contraction only in foreign currency loans that have much lesser impact on inflation.

These figures, while lower than the ones from September‑October (2,0%-2,3%), don’t look radically different; they indicate that corporate lending continues to grow. The Central Bank’s attempt to explain the severe softening of its monetary signals by «significant cooling of corporate lending» is not, therefore, backed with facts. Many market players attribute the Central Bank’s sudden change of heart to political pressure.

While emphasizing the pro‑inflationary impact of an expansion of corporate credit, the Central Bank fails to mention massive war‑driven budget stimulus as the major cause of inflation. It once again raises the issue of the Bank’s decision‑making being politically constrained. The Central Bank does mention the possibility of a budget expansion in 2025 as one of the factors that may lead to further tightening of monetary policies; nevertheless, its emphasis on cooling the lending and its omission of the federal budget deficit spending hint at a profound dependency on the Kremlin.

It was only after December 20 that the Central Bank released new data that did show some cooling of corporate crediting in November; still, it doesn’t appear to make the hypothesis of «significant cooling» of corporate lending any more convincing. In November, corporate credit was still up by 0,8% month‑over-month; this included growth in lending in rubles (the most impactful regarding inflation) by 1,5% and a contraction only in foreign currency loans that have much lesser impact on inflation.

These figures, while lower than the ones from September‑October (2,0%-2,3%), don’t look radically different; they indicate that corporate lending continues to grow. The Central Bank’s attempt to explain the severe softening of its monetary signals by «significant cooling of corporate lending» is not, therefore, backed with facts. Many market players attribute the Central Bank’s sudden change of heart to political pressure.

While emphasizing the pro‑inflationary impact of an expansion of corporate credit, the Central Bank fails to mention massive war‑driven budget stimulus as the major cause of inflation. It once again raises the issue of the Bank’s decision‑making being politically constrained. The Central Bank does mention the possibility of a budget expansion in 2025 as one of the factors that may lead to further tightening of monetary policies; nevertheless, its emphasis on cooling the lending and its omission of the federal budget deficit spending hint at a profound dependency on the Kremlin.

The Central Bank’s decision to pause interest rate hikes has thrown Russia into a period of even higher uncertainty. The 21% interest rate is one of the highest in the world, a major impediment to business activity and expansion. Russian business can’t be happy with it and demands nothing short of a severe rate decrease, which the Central Bank categorically refuses to do. Meanwhile, business activity is collapsing. In December, Maxim Reshetnikov, Russia’s Minister of Economic Development, admitted at the VTB Bank annual «Russia Is Calling!» forum (attended by Putin who gave his keynote remarks) that businesses were severely cutting their investment programs because of high interest rates.

The Central Bank’s decision to pause interest rate hikes has thrown Russia into a period of even higher uncertainty. The 21% interest rate is one of the highest in the world, a major impediment to business activity and expansion. Russian business can’t be happy with it and demands nothing short of a severe rate decrease, which the Central Bank categorically refuses to do. Meanwhile, business activity is collapsing. In December, Maxim Reshetnikov, Russia’s Minister of Economic Development, admitted at the VTB Bank annual «Russia Is Calling!» forum (attended by Putin who gave his keynote remarks) that businesses were severely cutting their investment programs because of high interest rates.

As the Central Bank noted in its monthly “Monitoring of the Enterprises” report, the «composite business climate index» plunged to 4,2 in December, as opposed to 8,3 in Q1 2024, 10,5 in Q2 2024, and 5,0–5,3 in October‑November. A survey of enterprises records a decline in their business activity, while inflation expectations continue to grow, pointing to risks of stagflation.

The Central Bank itself sees the current environment as manifestly pro‑inflationary. It was made clear by the summary of the December 20 interest rate discussion: «the balance of risks remains significantly skewed towards pro‑inflationary ones». If by the time of the Central Bank's Board meeting in February «the trends in inflation dynamics do not reverse, it will be possible to return to the issue of raising the key rate».

Inflation will likely remain high in January‑February 2025, particularly given the fact that the Russian Ministry of Finance planned to deliver a monstrous federal spending package of around 7 trillion rubles in December, fueling the growth of prices; we will get precise information in late January.

As the Central Bank noted in its monthly “Monitoring of the Enterprises” report, the «composite business climate index» plunged to 4,2 in December, as opposed to 8,3 in Q1 2024, 10,5 in Q2 2024, and 5,0–5,3 in October‑November. A survey of enterprises records a decline in their business activity, while inflation expectations continue to grow, pointing to risks of stagflation.

The Central Bank itself sees the current environment as manifestly pro‑inflationary. It was made clear by the summary of the December 20 interest rate discussion: «the balance of risks remains significantly skewed towards pro‑inflationary ones». If by the time of the Central Bank's Board meeting in February «the trends in inflation dynamics do not reverse, it will be possible to return to the issue of raising the key rate».

Inflation will likely remain high in January‑February 2025, particularly given the fact that the Russian Ministry of Finance planned to deliver a monstrous federal spending package of around 7 trillion rubles in December, fueling the growth of prices; we will get precise information in late January.

There are other factors that may push inflation even higher in the coming weeks and months, including the recent sharp devaluation of the ruble. If inflation doesn’t calm down by February (the chances for this are slim), the Central Bank with have no choice but to either raise the interest rate (accelerating economic slowdown) or to pause it, giving in to lobbyists and unleashing persistent double‑digit inflation.

There is hardly any positive scenario for the Russian economy at the moment. The country is likely to face either surging inflation or rapid economic cooling — or both.

There are other factors that may push inflation even higher in the coming weeks and months, including the recent sharp devaluation of the ruble. If inflation doesn’t calm down by February (the chances for this are slim), the Central Bank with have no choice but to either raise the interest rate (accelerating economic slowdown) or to pause it, giving in to lobbyists and unleashing persistent double‑digit inflation.

There is hardly any positive scenario for the Russian economy at the moment. The country is likely to face either surging inflation or rapid economic cooling — or both.

Vladimir Putin and the international media have been emphasizing the impressive 2024 Russian GDP growth, which is expected to reach 3,9%, but there are two major problems. First, this is, to a large extent, a yesterday’s story: high GDP growth was mostly recorded in the first two quarters of 2024 (5,4% in Q1 2024 and 4,1% n Q2 2024), while in Q3 2024, it slowed down to 3,1% and in Q4, to a 2,0–3,0% growth, as projected by the Central Bank. For 2025, the Central Bank projects a mere 0,5–1,5% GDP growth. Given recent economic trends, this forecast is likely to be revised downwards. At his annual press conference in December, Putin acknowledged that 2025 GDP growth would be much slower than in 2024.

Vladimir Putin and the international media have been emphasizing the impressive 2024 Russian GDP growth, which is expected to reach 3,9%, but there are two major problems. First, this is, to a large extent, a yesterday’s story: high GDP growth was mostly recorded in the first two quarters of 2024 (5,4% in Q1 2024 and 4,1% n Q2 2024), while in Q3 2024, it slowed down to 3,1% and in Q4, to a 2,0–3,0% growth, as projected by the Central Bank. For 2025, the Central Bank projects a mere 0,5–1,5% GDP growth. Given recent economic trends, this forecast is likely to be revised downwards. At his annual press conference in December, Putin acknowledged that 2025 GDP growth would be much slower than in 2024.

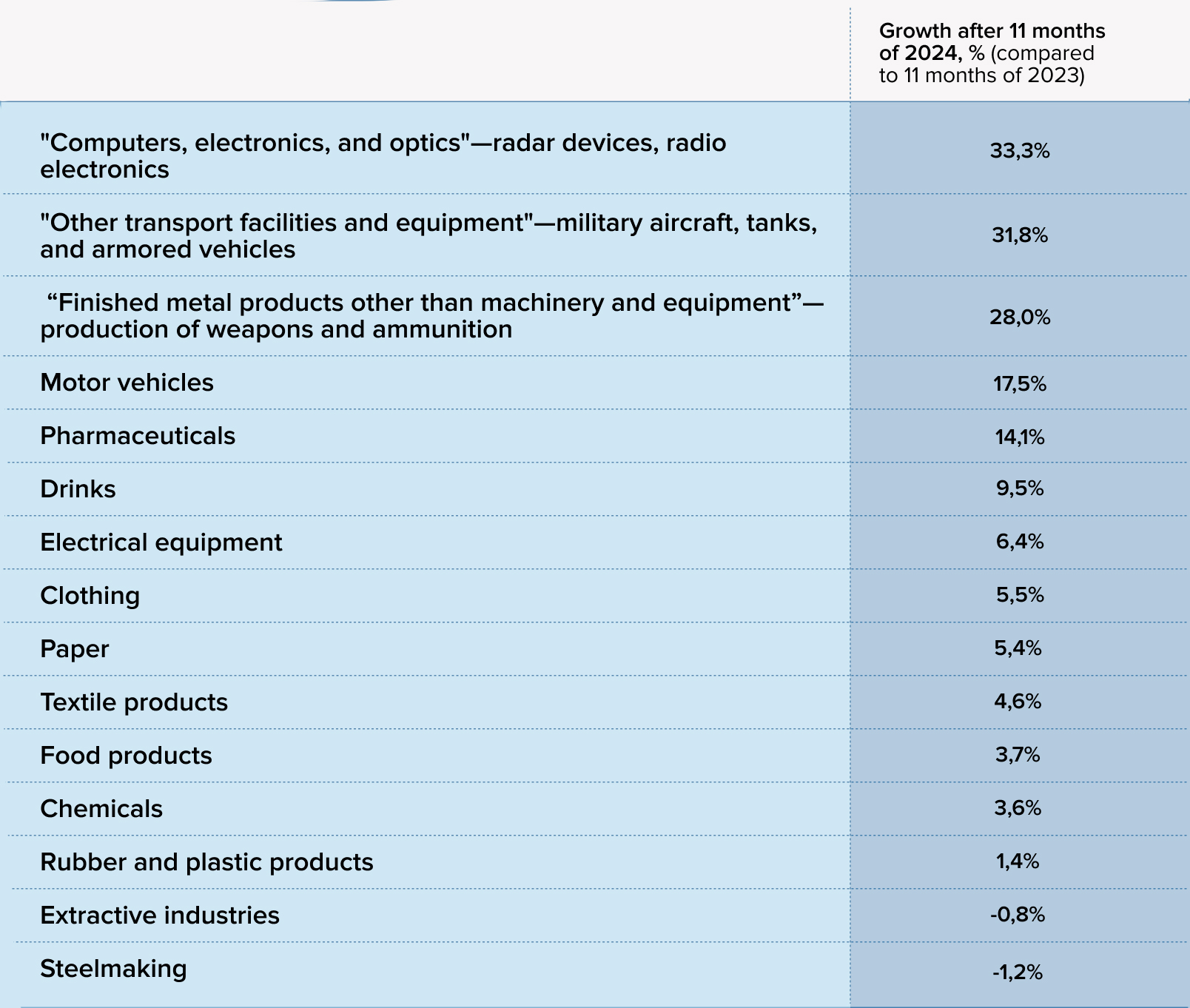

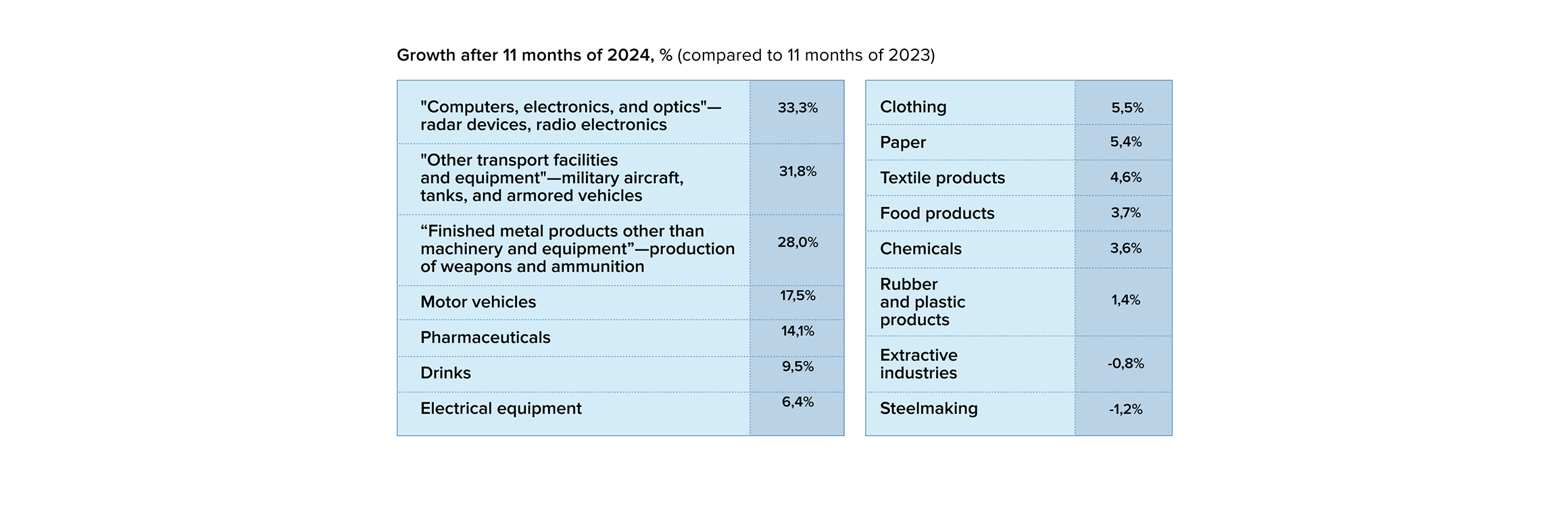

Second, the breakdown of industrial output dynamics after 11 months of 2024 clearly shows that growth is primarily concentrated in military‑related areas like «finished metal products other than machinery and equipment» (includes production of weapons and ammunition), «other transport facilities and equipment» (includes military aircraft, tanks, and armored vehicles) and «computers, electronics, and optics» (includes radar devices, radio electronics). Growth in civilian industries remains modest at best, with a contraction recorded in steelmaking and the extraction of mineral resources (see Table 1).

In the fall of 2024, the Center for Macroeconomic Analysis and Short‑Term Forecasting known under the Russian abbreviation CMAKP, Russia’s major pro‑government macroeconomic analysis center, published a report confirming that current Russian capital investment dynamics were largely driven by military production, while capital expenditure in most civilian industries was depressed.

Second, the breakdown of industrial output dynamics after 11 months of 2024 clearly shows that growth is primarily concentrated in military‑related areas like «finished metal products other than machinery and equipment» (includes production of weapons and ammunition), «other transport facilities and equipment» (includes military aircraft, tanks, and armored vehicles) and «computers, electronics, and optics» (includes radar devices, radio electronics). Growth in civilian industries remains modest at best, with a contraction recorded in steelmaking and the extraction of mineral resources (see Table 1).

In the fall of 2024, the Center for Macroeconomic Analysis and Short‑Term Forecasting known under the Russian abbreviation CMAKP, Russia’s major pro‑government macroeconomic analysis center, published a report confirming that current Russian capital investment dynamics were largely driven by military production, while capital expenditure in most civilian industries was depressed.

Such war‑focused model is unsustainable, as it can only be financed from the state budget, which is running tight. The Russian government was only able to increase military spending by just 26% for 2025, as opposed to nearly 70% increase in 2024, and 35–40% in 2022–2023, reflecting the depletion of the state’s financial reserves. Revenues from arms exports are at historic lows and are likely to shrink even further due to Russia’s focus on military production for battlefield needs in Ukraine, and high interest rates. Such high level of growth in military‑related industries as registered in 2023–2024 is unlikely to continue; in 2024, according to Rosstat data, this growth clearly peaked.

The depressed economic situation already is already impacting the Russian budget: according to the Ministry of Finance, corporate profit tax earnings have shrunken by 7% year‑over-year after 11 months of 2024.

Such war‑focused model is unsustainable, as it can only be financed from the state budget, which is running tight. The Russian government was only able to increase military spending by just 26% for 2025, as opposed to nearly 70% increase in 2024, and 35–40% in 2022–2023, reflecting the depletion of the state’s financial reserves. Revenues from arms exports are at historic lows and are likely to shrink even further due to Russia’s focus on military production for battlefield needs in Ukraine, and high interest rates. Such high level of growth in military‑related industries as registered in 2023–2024 is unlikely to continue; in 2024, according to Rosstat data, this growth clearly peaked.

The depressed economic situation already is already impacting the Russian budget: according to the Ministry of Finance, corporate profit tax earnings have shrunken by 7% year‑over-year after 11 months of 2024.

While after 11 months of 2024 the federal budget deficit was kept within RUR 0,4 trillion, or just 0,2% GDP, this doesn’t mean much. Most of the deficit spending was expected to occur in December, when the Ministry of Finance intended to spend around RUR 7 trillion (the final figure to be published in January).

As a result, the federal budget deficit for 2024 is anticipated to exceed RUR 3,3 trillion, more than twice as much as initially planned. Full fiscal results of 2024 — including the final budget deficit figure and the amount of funds drawn from the Russian National Wealth Fund to cover the deficit — should be published by mid‑January 2025.

While after 11 months of 2024 the federal budget deficit was kept within RUR 0,4 trillion, or just 0,2% GDP, this doesn’t mean much. Most of the deficit spending was expected to occur in December, when the Ministry of Finance intended to spend around RUR 7 trillion (the final figure to be published in January).

As a result, the federal budget deficit for 2024 is anticipated to exceed RUR 3,3 trillion, more than twice as much as initially planned. Full fiscal results of 2024 — including the final budget deficit figure and the amount of funds drawn from the Russian National Wealth Fund to cover the deficit — should be published by mid‑January 2025.

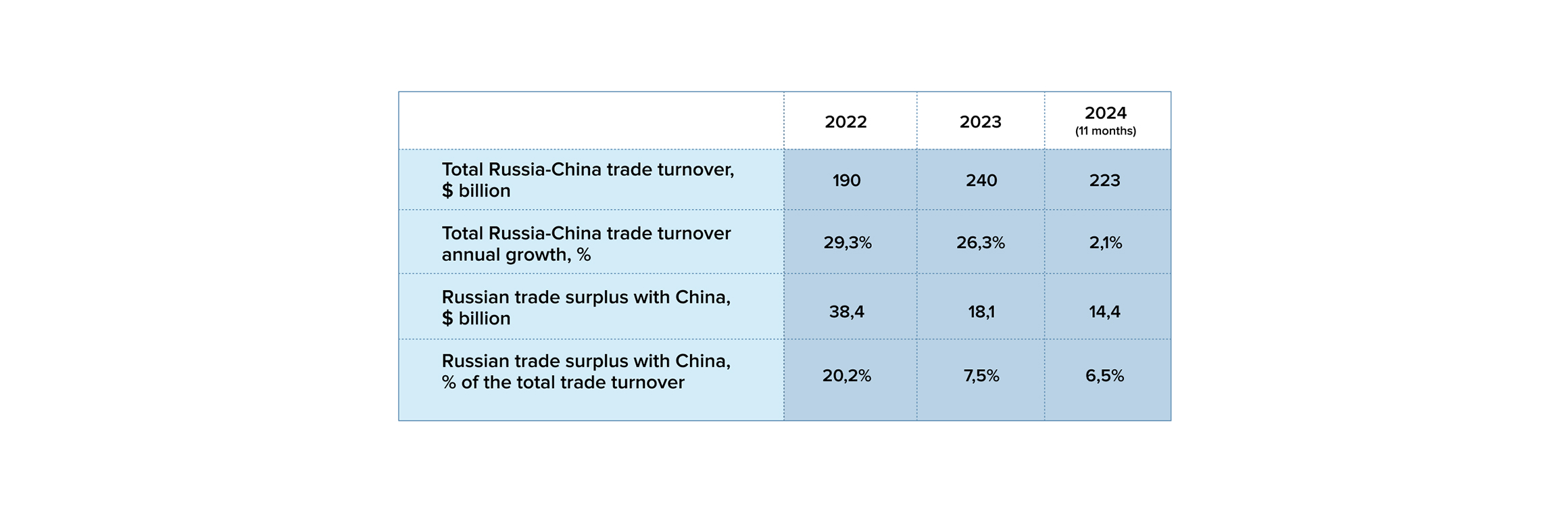

2024 was a very disappointing year for Russia’s hopes that China would provide massive economic aid to mitigate Putin’s economic woes. This didn’t happen. Despite a number of high‑level summits, no breakthroughs have been achieved with new projects like «Power of Siberia‑2» gas pipeline, and there’s little hope for better progress in 2025. Sino‑Russian economic relations obviously peaked in 2024.

2024 was a very disappointing year for Russia’s hopes that China would provide massive economic aid to mitigate Putin’s economic woes. This didn’t happen. Despite a number of high‑level summits, no breakthroughs have been achieved with new projects like «Power of Siberia‑2» gas pipeline, and there’s little hope for better progress in 2025. Sino‑Russian economic relations obviously peaked in 2024.

Mutual trade turnover has grown only by 2,1% after 11 months of 2024, as opposed to 26–29% year‑over-year growth in 2022–2023. Russian exports to China stagnated at 0,4% growth, while trade expansion was largely due to 4% growth in Chinese exports to Russia. As a result, Russia’s trade surplus with China shrank even further (see Table 2), contributing to a weakening of the ruble exchange rate and putting at risk a net positive trade balance with China in the near future. This reflects a crisis of mutual trade payments in 2024 caused by the decision of major Chinese banks and companies to factor in the risks of Western secondary sanctions. It also shows that a limit has been reached in the trade relations.

Russia mostly exports only basic commodities, whose prices are not growing, to China; for many Russian goods, Chinese markets remain closed. Conversely, China exports machinery, equipment, and other more sophisticated products to Russia, competing with Russian manufacturers. In response to this, Russia has taken restrictive measures against Chinese imports, for instance, utilization fees for cars and agricultural machinery.

Mutual trade turnover has grown only by 2,1% after 11 months of 2024, as opposed to 26–29% year‑over-year growth in 2022–2023. Russian exports to China stagnated at 0,4% growth, while trade expansion was largely due to 4% growth in Chinese exports to Russia. As a result, Russia’s trade surplus with China shrank even further (see Table 2), contributing to a weakening of the ruble exchange rate and putting at risk a net positive trade balance with China in the near future. This reflects a crisis of mutual trade payments in 2024 caused by the decision of major Chinese banks and companies to factor in the risks of Western secondary sanctions. It also shows that a limit has been reached in the trade relations.

Russia mostly exports only basic commodities, whose prices are not growing, to China; for many Russian goods, Chinese markets remain closed. Conversely, China exports machinery, equipment, and other more sophisticated products to Russia, competing with Russian manufacturers. In response to this, Russia has taken restrictive measures against Chinese imports, for instance, utilization fees for cars and agricultural machinery.

Russian analysts with ties to the government admit that China refrains from either investing in Russia or supplying critical technologies needed to boost Russia’s manufacturing output. Moreover, Chinese companies kept withdrawing from Russia, like Wison New Energies that quit Novatek’s LNG projects amid U.S. sanctions, or curtailing their operations, like the carmakers who refused to build new factories in Russia.

Chinese banks continued to snub sanctioned Russian clients. The pressure was renewed in November, with the U.S. sanctioning 50 more Russian banks, to which, as reported by the Russian media, Chinese banks adhered. Another problem for Russia is the Chinese economic slowdown, which has already caused a downturn in some major China‑oriented Russian industries. Two cases in point are coal and steel, where the 2024 output contraction was evidently caused by the Chinese economic slowdown and hostile policies, such as import tariffs for Russian coal introduced after 2024.

Russian analysts with ties to the government admit that China refrains from either investing in Russia or supplying critical technologies needed to boost Russia’s manufacturing output. Moreover, Chinese companies kept withdrawing from Russia, like Wison New Energies that quit Novatek’s LNG projects amid U.S. sanctions, or curtailing their operations, like the carmakers who refused to build new factories in Russia.

Chinese banks continued to snub sanctioned Russian clients. The pressure was renewed in November, with the U.S. sanctioning 50 more Russian banks, to which, as reported by the Russian media, Chinese banks adhered. Another problem for Russia is the Chinese economic slowdown, which has already caused a downturn in some major China‑oriented Russian industries. Two cases in point are coal and steel, where the 2024 output contraction was evidently caused by the Chinese economic slowdown and hostile policies, such as import tariffs for Russian coal introduced after 2024.

While Donald Trump’s policies vis‑à-vis Russia remain unknown and we’d prefer not to speculate at least until some clarity on this issue emerges after January 20, certain trends may complicate things for Russia in 2025, notably pressure on oil prices and potential tariffs against China.

Both developments may be quite painful for the Russian economy. Russian Urals export crude oil was trading just slightly above $60 per barrel in the recent months, as opposed to the $70 per barrel forecast of federal budget laws for 2024 and 2025. Due to relatively low oil prices, Russian exports largely stagnated throughout 2024 at 0,9% growth after 10 months. If the prices fall even lower in 2025, this will clearly exacerbate Putin’s budget problems.

As discussed above, the Chinese economic slowdown already has a negative impact on major sectors of the Russian economy. Should Chinese economic growth be negatively affected in 2025 by tariff pressure from the Trump administration, this may have corresponding consequences for Russian exporters and producers.

While Donald Trump’s policies vis‑à-vis Russia remain unknown and we’d prefer not to speculate at least until some clarity on this issue emerges after January 20, certain trends may complicate things for Russia in 2025, notably pressure on oil prices and potential tariffs against China.

Both developments may be quite painful for the Russian economy. Russian Urals export crude oil was trading just slightly above $60 per barrel in the recent months, as opposed to the $70 per barrel forecast of federal budget laws for 2024 and 2025. Due to relatively low oil prices, Russian exports largely stagnated throughout 2024 at 0,9% growth after 10 months. If the prices fall even lower in 2025, this will clearly exacerbate Putin’s budget problems.

As discussed above, the Chinese economic slowdown already has a negative impact on major sectors of the Russian economy. Should Chinese economic growth be negatively affected in 2025 by tariff pressure from the Trump administration, this may have corresponding consequences for Russian exporters and producers.

The developments described above continue to limit Putin’s ability to continue his war against Ukraine in the long run:

The developments described above continue to limit Putin’s ability to continue his war against Ukraine in the long run:

Russia’s economic troubles notably increased in the recent months. Inflation is at record highs and shows no signs of easing; the facts point out that it will persist in the near future. The Central Bank is at a dangerous crossroads: either it gives in to political and lobbyist pressure and stops raising interest rates, which will most certainly spark higher inflation, or it continues its rate hikes, which may or may not affect inflation. In the past year and a half, it didn’t do so because inflation was to a large extent driven by the budget deficit spending; it is certain, however, that it would continue to cool down economic activity, driving Russia into stagflation or even a recession.

The Central Bank’s recent decision not to raise the key interest rate added more uncertainty to the situation. More clarity is expected in the coming weeks, when new data on inflation becomes available after January 15, 2025, and the Central Bank holds its scheduled Board meeting on the key interest rate in February.

Russia’s economic troubles notably increased in the recent months. Inflation is at record highs and shows no signs of easing; the facts point out that it will persist in the near future. The Central Bank is at a dangerous crossroads: either it gives in to political and lobbyist pressure and stops raising interest rates, which will most certainly spark higher inflation, or it continues its rate hikes, which may or may not affect inflation. In the past year and a half, it didn’t do so because inflation was to a large extent driven by the budget deficit spending; it is certain, however, that it would continue to cool down economic activity, driving Russia into stagflation or even a recession.

The Central Bank’s recent decision not to raise the key interest rate added more uncertainty to the situation. More clarity is expected in the coming weeks, when new data on inflation becomes available after January 15, 2025, and the Central Bank holds its scheduled Board meeting on the key interest rate in February.

These forthcoming data‑related events will shed more light on the dynamics of the Russian economy in 2025:

These forthcoming data‑related events will shed more light on the dynamics of the Russian economy in 2025:

Between inflation and stagflation, lobbyists versus bankers, and the need for sanctions control

By Vladimir Milov

November 20, 2024

Report

Report Inflation, budget and labor shortages, and a cooling of relations with China

By Vladimir Milov

October 15, 2024

Report

Report Vladimir Putin’s corridor of economic opportunities is narrowing

By Vladimir Milov

September 05, 2024

Between inflation and stagflation, lobbyists versus bankers, and the need for sanctions control

By Vladimir Milov

November 20, 2024

Report

Report Inflation, budget and labor shortages, and a cooling of relations with China

By Vladimir Milov

October 15, 2024

Report

Report Vladimir Putin’s corridor of economic opportunities is narrowing

By Vladimir Milov

September 05, 2024