EU Imports of Russian Gas

In 2023, the EU was the largest buyer of Russia's pipeline gas, purchasing 36% of its exports, followed by Turkey (31%) and China (28%)

By Mikhail Krutikhin March 12, 2024

In 2023, the EU was the largest buyer of Russia's pipeline gas, purchasing 36% of its exports, followed by Turkey (31%) and China (28%)

By Mikhail Krutikhin March 12, 2024

In 2023, the EU was the largest buyer of Russia's pipeline gas, purchasing 36% of its exports, followed by Turkey (31%) and China (28%). No sanctions have been imposed on Russian pipeline gas flowing into the EU.

In 2021, Russian gas supplied to Europe via pipeline amounted to 155 bcm (5.5 Tcf), according to the Paris‑based International Energy Agency (IEA). In 2022, it fell to 62 bcm (2.2 Tcf) and in 2023— to 28 bcm (0.99 Tcf). Further decline is expected for 2024–2025.

In the spring of 2022, the EU announced a program aimed at termination of pipeline gas imports from Russia by 2027 (the REPowerEU plan). Some EU members have stopped Russian gas imports (with the help of Putin who ordered Gazprom to phase out the supply flows), but a few European countries remain very dependent on Russian gas supply despite the looming 2027 deadline.

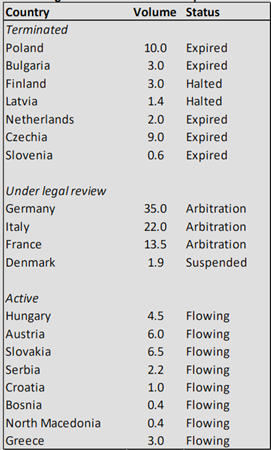

Status of Gazprom’s long‑term contracts in Europe, bcma

Source: OIES

The countries that evidently require further encouragement to switch from Russian piped gas to alternative supplies are Hungary, Austria, and Slovakia.

The European imports of LNG of Russian origin has been neither banned nor restricted. The EU is considering such a measure, but it is divided on how to do it. The largest Russian LNG importers —Belgium, France, and Spain—argue that their long‑term contracts with suppliers of Russia‑sources LNG cannot be severed painlessly. The current plan would give each EU member state the option to keep importing Russian LNG or block it, depending on individual circumstances.

An important aspect is the ownership of this LNG: most of the deliveries belong to producers and traders who do not pay any royalties and taxes to the Russian budget because of a “special tax regime”, which makes major Arctic LNG projects in Russia exempt from taxes for twelve years. Apart from Russia’s Novatek and Gazprom, “Russian” LNG suppliers are France’s TotalEnergies or China’s CNPC and Silk Way Fund. The militarized state budget of Russia gets next to nothing from such sales.

Until the Arctic LNG 2 project begins deliveries, the EU receives LNG from the following projects (mln t, Kpler data for 2023):

The European terminals that received this LNG volume are as follows (mln t):

About 20% of the total volume of Russian LNG does not end in the EU but is transshipped at the European terminals for deliveries elsewhere. In 2015, Belgian natural gas transmission system operator Fluxys signed a 20‑year contract with Yamal LNG for the transshipment of as much as 8 mtpa (about 11 bcma) of Yamal LNG, with the first loading taking place in 2019. In December 2019, Zeebrugge LNG commissioned its fifth storage tank to support year‑round LNG deliveries from Yamal, mainly for shipment to Asian markets. Besides Zeebrugge, the Montoir‑de-Bretagne terminal is also transshipping Yamal LNG via the ship‑to-ship process. In June 2015, French energy company Engie and Yamal LNG’s majority owner, Novatek, announced they had concluded a sales and purchase agreement for Engie to receive 1 million tons of LNG from Yamal at Montoir annually for 23 years as of 2018. The contract was inherited by TotalEnergies in 2018.

This report evaluates the effectiveness of U.S. sanctions targeting Russian companies and individuals using the detailed trade data from 2021–2022 compiled by the Federal Customs Service of Russia

By Free Russia Foundation

January 30, 2023

Report

Report In the few months following the start of its war on Ukraine, Russia became the most sanctioned nation in the world. The total number of sanctions levied against Russia is currently estimated at 11,000

By Sergey Aleksashenko

November 04, 2022

This report evaluates the effectiveness of U.S. sanctions targeting Russian companies and individuals using the detailed trade data from 2021–2022 compiled by the Federal Customs Service of Russia

By Free Russia Foundation

January 30, 2023

Report

Report In the few months following the start of its war on Ukraine, Russia became the most sanctioned nation in the world. The total number of sanctions levied against Russia is currently estimated at 11,000

By Sergey Aleksashenko

November 04, 2022